All Categories

Featured

Table of Contents

We aren't just speaking about celebrating Harmony week every year; the varying experiences, viewpoints, abilities and backgrounds of our home loan brokers allows us to: Have a far better social relationship, much better links with and understanding of the requirements of clients. For one, it makes us discreetly knowledgeable about the various cultural subtleties.

What we have actually seen is that typically, it's the older generation that likes to talk with a person who talks their language, also though they might have been in the country for a long time. No matter, every Australian requirements to be 100% clear when making one of the most significant choices in their life that is purchasing their initial home/property.

Transparent Interest-only Mortgage Near Me – Brookdale WA

For us, it's not just regarding the home financing. Most importantly, the home mortgage is a way to an end, so we ensure that the home funding is suited to your particular requirements and objectives. In order to do this, we understand and maintain ourselves upgraded on the loaning plans of nearly 40 loan providers and the policy exemptions that can get an application approved.

This lines up completely with our target markets which consist of non-residents, self-employed, unusual employment, impaired credit report, low deposit (credit score for mortgage), and various other areas where great customers are allow down by the financial institutions. To conclude, we have systems in position which are carefully checked and refined not to allow anybody down. A frequently forgotten but essential facet when selecting a home loan broker is domain experience, i.e.

To speak with talk of the best mortgage brokers home loan Sydney, provide us a telephone call on or fill out our brief on the internet assessment form.

Reputable Equity Release (Perth 6112 WA)

We answer a few of one of the most frequently asked inquiries regarding accessing home loan brokers in Perth. The duty of Perth home loan brokers is to give mortgage funding services for their customers, using their neighborhood market expertise and experience. Perth home mortgage brokers, such as our team at Lendstreet, pride themselves on finding the most effective home loan borrowing option for your Perth home purchase while assisting you via the whole procedure.

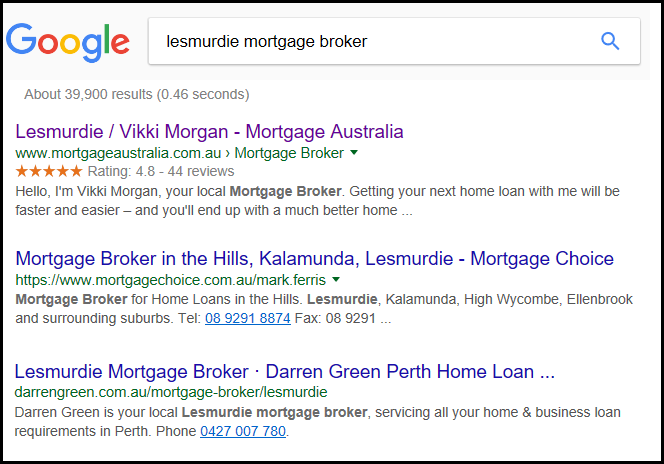

There are a great deal of mortgage brokers in Perth. Below are 10 excellent factors to consider me most of all the others. All missed phone calls will certainly be returned within 4 service hours All e-mails obtained prior to 5pm will be responded to in the same day Authorised debt representative (CRN: 480368) of AFG (ACL: 389087) Participant of the Mortgage & Finance Association of Australia (577975) Member of the Australian Financial Complaints Authority or AFCA (52529) BSc Economics from the London Institution of Economics Diploma of Money and Home Mortgage Broking Administration Certificate IV in Finance and Home Mortgage Broking Component of a WA had and ran service whose emphasis is only on the Perth market.

All solutions come at no charge to you and there are no Clawback fees. Readily available to meet you from 7 am to 7 pm weekdays and available on weekend breaks. Over 1400 items, from greater than 30 lending institutions to choose from. Our partnership does not end with the settlement of your financing.

Personalised Refinancing – Brookdale 6112 WA

All information provided is held in the strictest confidence and is dealt with in line with the 1988 Personal privacy Act.

In our experience as registered home loan brokers, we can take the stress and anxiety out of mortgage contrast. We compare products from over 30+ lenders from the large banks to the little lenders. We utilise only the ideal and simple comparing tools to pinpoint the very best proprietor inhabited or financial investment car loan for you.

This in reality can make the car loan product much more pricey in the long-lasting. Many banks will certainly win over consumers by showing only the advertised rate of interest rate without factoring in elements that include onto your lending settlements.

Flexible Debt-to-income Ratio

With so much information out there, locating the best mortgage rates that ideal fit your monetary circumstance can be a tough task. It's our task to supply you with complete product comparisons, including all the concealed charges and fees so that you compare any kind of mortgage product as properly as feasible.

Our mortgage brokers have a collective 20+ years experience in the market, are totally knowledgeable about the trends for the Perth market making us experts for the work. By offering a contrast device that can help you in making a far better economic decision, we're encouraging consumers and enlightening them along the way.

Experienced Fixed-rate Mortgage

All you require to do is give us a telephone call..

I serve as the intermediary between you and the loan provider, making sure a smooth and effective procedure, and saving you the anxiety. With virtually twenty years in the home mortgage market, I offer thorough recommendations on all facets of mortgage loaning. Whether you're weighing the advantages of a fixed-rate vs. an adjustable-rate mortgage or concerned regarding financing attributes and penalties, I'm right here to give clearness and guidance.

My extensive experience and relationships within the sector enable me to protect far better rates of interest and perhaps also get certain fees waived for you. To sum up the above, the benefits of making use of the services of a mortgage broker such as myself consist of: My connections can open up doors to car loan alternatives you could not find by yourself, customized to your unique circumstance.

Thorough First-time Home Buyer

When you pick an ideal loan early on, you'll seldom have to stress over whether you can still afford it when rates increase and you'll have a simpler time handling your monthly payments. Selection is the greatest advantage that a mortgage broker can provide you with (refinancing options). The factor is that they have partnerships with a wide variety of loan providers that include financial institutions, building cultures, and credit rating unions

In general, the quicker you function with a home loan broker, the much better. That's since collaborating with one will certainly allow you to do even more in less time and get accessibility to far better bargains you probably won't find by yourself. Certainly you additionally need to be selective with the mortgage broker that you select to utilize.

Aside from that, make sure that they are licensed - pre-approval. It might additionally be valuable to get suggestions from individuals you trust on brokers they have made use of in the past

A mortgage broker is a monetary expert who specialises in home and investment finance financing. They link debtors with potential lenders and assist promote the whole procedure. When you link with a qualified financial broker for a mortgage or financial investment car loan requirement, they will rest with you to comprehend your details financial needs and obtaining capability and assist you secure an ideal loan at a market leading rate of interest.

Reliable Mortgage Terms Near Me

We do not count on offering an one time service yet objective to nurture a relied on relationship that you can rely on over and over again. We comprehend that every customer has unique requirements, as a result, we make every effort to provide custom home loan services that finest align with your choices each time. With an impressive record of satisfied customers and hundreds of sustained positive Google reviews as social evidence, we are the leading team you need to depend on for finding and securing your following mortgage approval in Perth.

Latest Posts

Professional Mortgage (Carlisle WA)

Value First-time Home Buyer Near Me (Perth)

Value Government-backed Mortgage Near Me